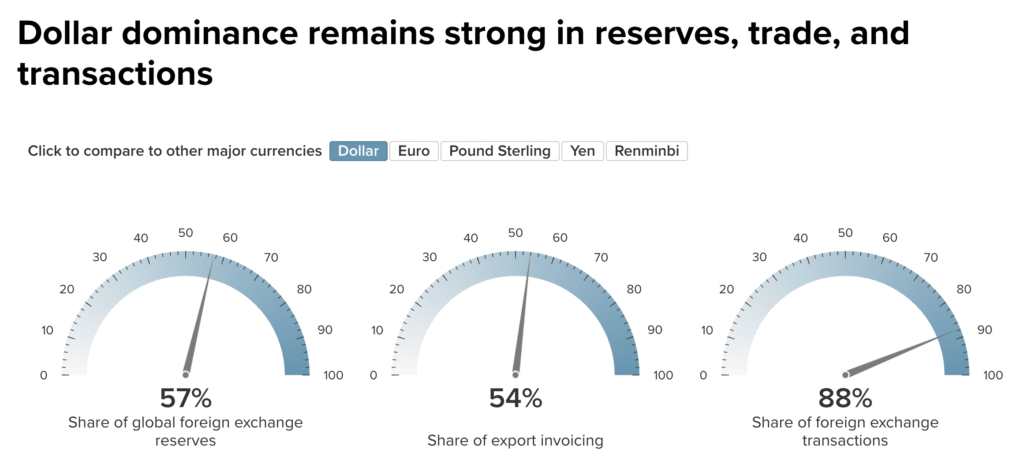

The US dollar is the world’s primary reserve currency. It is the main unit of account in global trade, mainly the trade of oil. It is the official currency of 11 countries, and the main currency peg for 66 other nations. It accounts for roughly 57% of all global cash reserves.

The US dollar is involved in around 90% of all cross-border transactions and is included in all seven of the major FX trading pairs.

This ubiquitous nature of the American currency has come to be known as dollar dominance.

Dollar dominance has been consistently challenged, first with the eurozone, and more recently with BRICS and the increasing oil industry in China. Despite common rhetoric about dollar dominance coming to an end (cited as de-dollarization), there is no clear indication that this is actually happening, and in many ways, quite the contrary.

What do we mean by currency strength?

Before determining how dominant the dollar is, it is important to define what we mean by ‘strong’ or ‘dominant’. After all, GBP is technically worth more than USD, but in terms of this report, what we mean by ‘strength’ is something different.

Currency strength

Currency strength refers to the value of the currency relative to others and the subsequent purchasing power that this currency has. In the FX market, this is influenced by factors such as:

- Inflation

- Economic growth

- Political stability

A strong currency will buy more of a weaker foreign currency and will often go hand-in-hand with a stronger economy. Conversely, a weak currency will buy less of a stronger foreign currency.

Understanding dollar dominance

Despite the US dollar being roughly the 9th-strongest currency in the world, below both the euro and the pound, it is the most dominant currency

It is the official currency of 11 countries, and the main currency peg for 66 other nations. It accounts for roughly 57% of all global cash reserves. Atlantic Council has a real-time Dollar Dominance Monitor that can be used to track the dollar’s dominance at any given time, factoring in share of global foreign exchange reserves, export invoicing and foreign exchange transactions.

The US dollar is involved in around 90% of all cross-border transactions and is included in all seven of the major FX trading pairs.

How dollar dominance is maintained

Dollar dominance is maintained by the US economy and the general perception of American exceptionalism in the world economy. Dollar dominance is maintained by these key factors.

1. Global trade & oil

Most global commodities, especially oil, are priced and traded in US dollars. This system forces countries to hold dollar reserves to participate in international trade, reinforcing demand for the dollar.

2. US Treasuries

US Treasury securities are considered the safest and most liquid assets globally. Central banks and sovereign wealth funds invest heavily in them for reserve purposes, reinforcing dollar demand and deepening its role in global finance.

3. Size and Openness of US Financial Markets

The US boasts the largest, most liquid, and transparent capital markets. Global investors and corporations prefer these markets for issuing debt, investing, and parking capital, activities that require and sustain dollar usage.

The USA & oil

Oil is often referred to as ‘black gold’ and is the most valuable physical commodity on Earth. Crude oil is the foundation of modern life and is the basis for virtually every product and industry around us.

The vast majority of oil trades are made in dollars. At the time of writing, crude oil is value at around $68 per barrel.

The two real questions here are why and how? Regarding why the US dollar is the currency used for a commodity not produced entirely in the US, the US can benefit and at least lean on the fact that the majority of oil is produced and consumed in the US, with 14.7% of US oil produced domestically, and 20.25 million barrels of petroleum per day.

Therefore, the US has a fair dominance in the industry simply based on the fact that the majority of oil is bought in dollars and produced in the US.

However, countries such as China, which has an enormous stake in the oil industry itself, being second on the list of the highest consuming countries for crude oil, trade oil in dollars, as well as yuan, as well as Russia, both known adversaries of the United States.

This is because the United States has implemented a system whereby oil must be traded in dollars, lest countries wish to incur terrible consequences. The US has put oil at the heart of its foreign policy, and for good reason.

The deal with Saudi Arabia

In the 1960s and 1970s, as the world began to modernise, demand for oil began to skyrocket. Due to oil-rich reserves and cheap labour, by 1972, 83% of American oil imports came from the Middle East.

In order to establish some kind of control against the oil-hungry Western nations, OPEC was formed, which is an organisation of oil-producing countries that began to cooperate in order to protect their countries and profits.

In 1974-75, the US managed to secure Saudi commitment to pricing oil in dollars, in exchange for arms and security. Petrodollar revenues were subsequently funnelled into US treasuries and cemented the dollar as OPEC’s trade currency. By late 1975, Saudi Arabia led OPEC to set oil prices in dollars, and made oil buyers hold large reserves of USD. Due to stable demand, the US dollar has achieved reserve currency status, explaining how it has managed to reach 57% of reserves. These ties created the ‘exorbitant privilege’ for the US, with strong demand for the dollar, global currency stability for allies and continuous Saudi investment into US debt. However, will this relationship remain monogamous forever? We will explore the current state of dollarisation, and analyse potential hints at alternative solutions.

1973 oil crisis

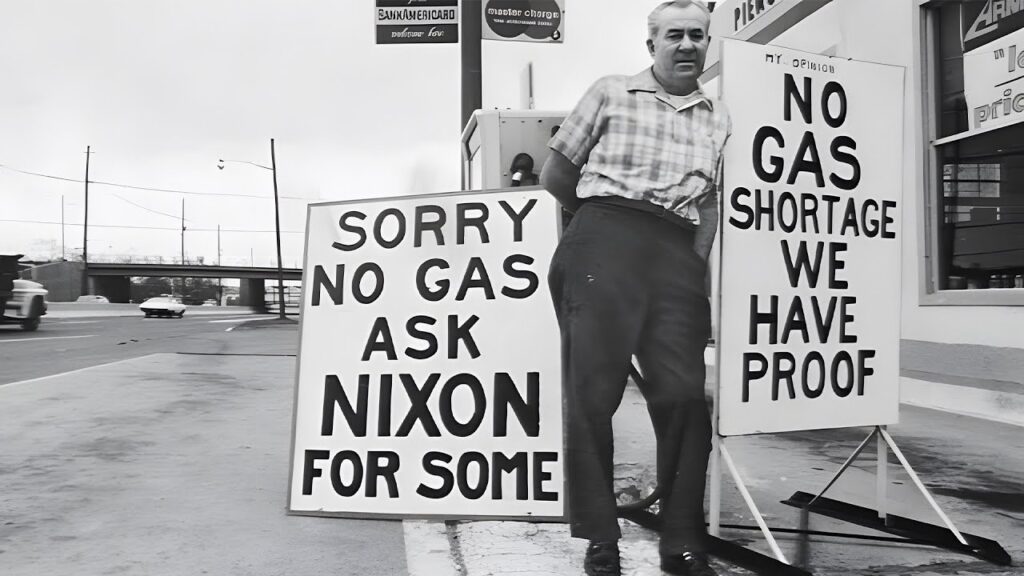

In 1973, an inevitable oil crisis struck, when King Faisal of Saudi Arabia blocked all oil trade to nations that had supported Israel during the Yom Kippur War – which included the USA. The heavy reliance on the Middle East for oil meant that the US had no choice but to try and strike a deal, or force trade.

Despite the tensions, the US managed to bargain a deal with Saudi Arabia, and the oil embargo was lifted in 1974 (after the US pressured Israel into negotiating a deal with Syria). By 1975, Saudi Arabia and the US had signed over $2bn worth of military contracts, including 60 fighter jets, securing the truce.

Saudi Arabia clearly benefited from this deal, and managed to obtain a huge amount of military power and backing in the region. But what the US gained was more valuable, which was a significant foothold in the oil economy, and an assurance that oil would be traded in dollars.

Shortly after, all countries within OPEC were convinced to price their oil in dollars, and also to keep their prices lower. Any countries that wanted to buy oil from the Middle East would now need to buy it in US dollars.

Recent analysis has suggested that somehow the deal was not for the benefit of US dollars being traded exclusively in oil, such as NextBigFuture stating that the deal “had nothing to do with currencies because the Saudis carried on selling in sterling after that” although it then follows to add that “later that year that the Kingdom stopped accepting the pound as payment”. Clearly, there was a mutual agreement for the benefit of both parties.

Creating the ‘Petrodollar’

But why would it matter if oil is traded in dollars? This is something that may seem trivial, almost purely a point of ego rather than any actual tangible value.

However, this is not the case, and ensuring that oil is bought and sold primarily in dollars is crucial to maintaining global dominance. Due to the US ensuring that oil is traded in dollars, if a country wants oil, it is easiest and most cost-efficient for them to use dollars.

Therefore, this ensures that all countries have a large amount of dollars in their reserves, ready to buy oil, and the dollar becomes the global currency. The foreign policy of the US, dating back since The Marshall Plan, means that now approximately 57% of all world reserves are in dollars.

These dollars have come to be known as ‘petrodollars’ – dollars kept entirely on reserve in order to buy oil. The result is that every single country in the world has an incentive to use dollars (to buy oil), and therefore, has an interest in America’s economy.

Therefore, if the dollar ceased to exist, then 57% of all money kept in global reserves would be gone, and essentially, the world economy as we know it would end. It means that the dollar is now the keystone of the global economy, and therefore every country in the world has an incentive for the US economy to survive and thrive. Most of the US’s foreign policy is now designed to maintain this.

Will the dollar always be dominant?

A common rebuttal to the fears around dollar dominance might be: so what? Does it matter which currency we use? After all, our transactions might remain the same, does it make a difference whether the pictures on the bank notes or the denominations in our accounts?

In short, it matters a great deal. The dominance of a currency can determine monetary policy, exchange rates, and psychologically the framing that one economy is dominant over another.

A simple question – why is it that when a colonial power invades a smaller country, it often introduces a new currency? Such as with the CFA franc imposed on post-colonial France, the dollar has a similar effect on the global economy.

As long as the World Bank and IMF exist, and are owed the money they are owed, the US dollar will remain dominant. Saudi Arabia teased the idea of trading oil in yuan in 2023, but has since been won back, meaning that oil is still primarily traded in dollars.

Furthermore, the US still remains the strongest and most dangerous military, so if push comes to shove, dollar dominance is likely here to stay.