You may or may not have heard of BlackRock, but it’s a company that has significant influence on the world economy.

In just 35 years, the company has managed to reach around $10 trillion in assets under management (AUM). For context, the GDP of the UK is around $3 trillion.

The influence of BlackRock has a big question mark on it, sliding on a scale from simply being a ubiquitous name to being the mastermind behind the world economy.

But how much do they actually control? Does BlackRock run the world?

What do BlackRock do?

BlackRock is an American investment company.

In a nutshell, this means that investors (either individuals or companies) will give BlackRock their money to invest for them. BlackRock will take this money and invest it where the investor wants, but often, where BlackRock discerns is the most profitable, in their structured ETFs and portfolios.

Ultimately, all investors want a return on their money, and BlackRock’s continuous success demonstrates that this usually happens. Therefore, most consumers will trust BlackRock to manage their money effectively, and at their discretion.

How did BlackRock get so powerful?

BlackRock was founded just 35 years ago in 1988 and is currently valued at around $90bn — the 147th most valuable company in the world at the time of writing.

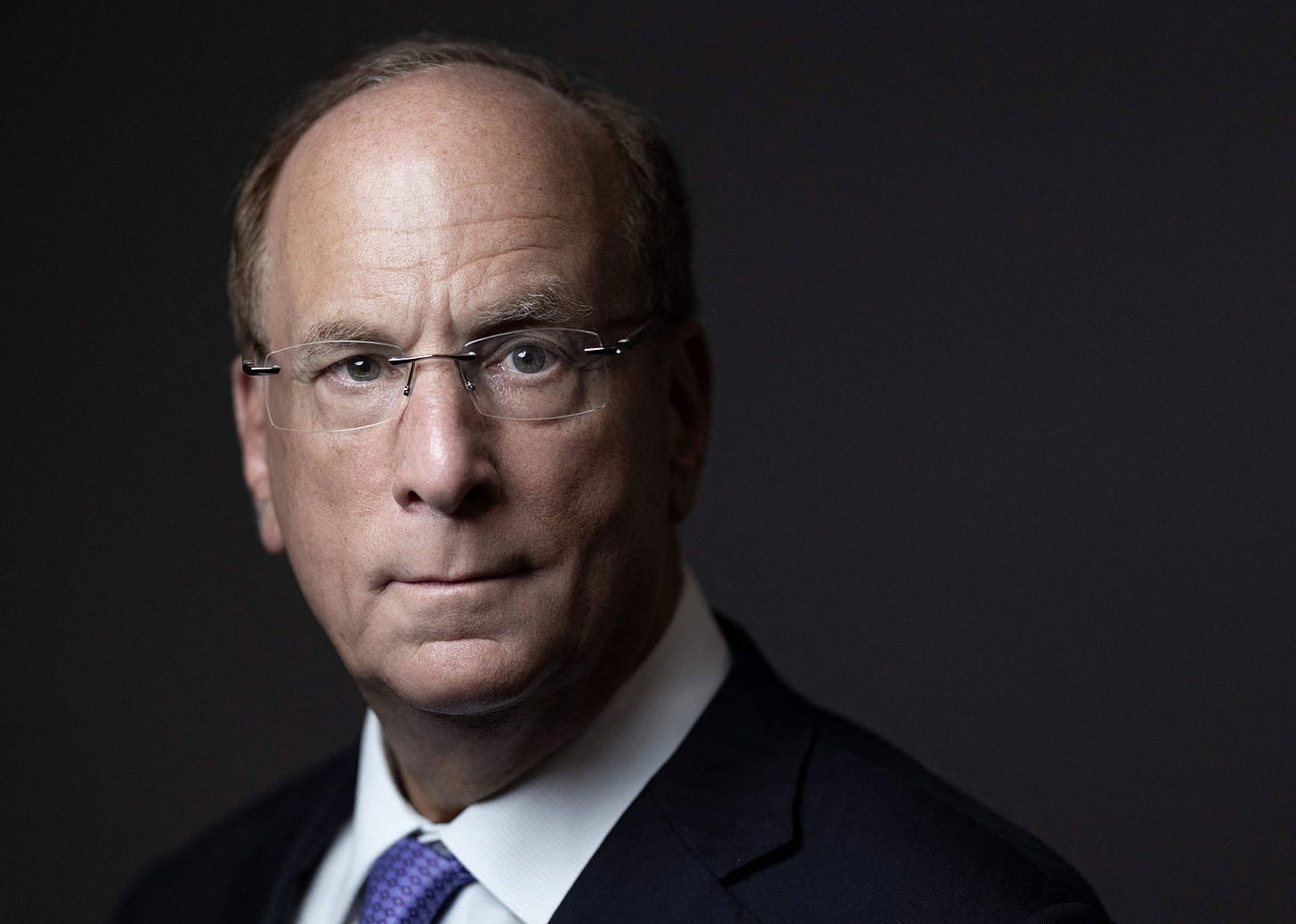

Yet their influence extends way beyond their value. BlackRock operates basically like any other investment management firm, except for a few details which make them a cut above. The main reason is a man called Larry Fink, the founder of BlackRock.

Larry Fink exploded the company in a staggering amount of time.

Blackstone group offered $5 million to the company in 1989, and within months, the business had quadrupled its assets to $2.7 billion. Just 10 years later in 1999, BlackRock was managing $165 billion in assets.

BlackRock continued this trajectory and dominated the turn of the century after its creation of Aladdin in 1998 – one of the first computer systems to measure investment activity and make predictions. BlackRock has also completed a number of successful acquisitions, such as Barclays Global Investors and Kreos.

BlackRock’s success is hard to pinpoint, but most sources claim that it is due to the focus on passive investment via index funds and its focus on technology and data analytics. Business Model Analyst goes into depth about the business model which has brought so much success to the company.

The Big Three

BlackRock is part of an even bigger monopoly, as the giant is not the only one of its kind. BlackRock, State Street, and Vanguard are the three largest index fund managers in the world, and are collectively known as the ‘Big Three’ index funds. They are all American, and together have $22 trillion AUM.

They also work together in complicated collusion: BlackRock owns State Street, whose largest shareholder is Vanguard. Vanguard is also the largest shareholder of BlackRock. They interlink in other ways, and have intertwined with each other to the point where nobody is quite sure how separate they are.

They were described as the “most powerful cartel in human history” by Republican candidate Vivek Ramaswamy in an X post in August 2023. The three companies are the largest shareholder in 88% of S&P 500 firms.

BlackRock itself owns majority shares in:

- Apple

- Microsoft

- Amazon

In short, these three companies oversee more of the world economy than anyone else.

Why is this a problem?

Any kind of monopoly is a problem, not just ethically, but economically.

The extent of BlackRock’s control is still up for debate too. Nobody is certain of how much they affect things, and of course BlackRock claims that it’s just an innocent investment firm.

But the problem is that while BlackRock doesn’t directly own anything, they oversee so much, and can steer investments at their discretion.

Some key points to note:

- BlackRock has the ability to influence corporate governance, and vote on key issues, such as board appointments and new policies.

- BlackRock offers risk management and data management which is used by central banks and governments to make informed decisions about economic and financial stability.

- BlackRock makes investment commentary, and influences investor sentiment.

- Companies must contact BlackRock before they make any big moves in the company.

None of these things are out of order, nor dangerous by themselves.

But it’s just the sheer scale that BlackRock operates on, and the cold fact that BlackRock basically has no competitors, means that these abilities are huge, as they’re widespread across the entire global economy.

With $10 trillion (and potentially more) being managed by one company, BlackRock has a say on almost everything. It has significant influence over certain areas of the market which influence decision-making even further.

For example, BlackRock, along with Vanguard, owns majority shares in:

- Warner Media

- Comcast

- Disney

- News Corp

These four companies control 90% of the US media landscape. BlackRock and Vanguard together are also among the five largest shareholders of the three biggest airlines. Too much concentration of power means that companies have no competitors, as they can be assured of BlackRock’s investment. Therefore, flight prices stay high, and can go even higher, and customers have no choice.

BlackRock can subtly steer decisions based on their own agenda, almost without anyone knowing.

It’s even starting to act like a debt collector. Just like the World Bank and IMF, BlackRock have generously offered support to Ukraine and rebuilding its economy after Russian destruction. But many savvy economists are aware that BlackRock are simply purchasing Ukraine, and “cashing in on devastation”.

So does BlackRock run the world?

At this point, who knows? And what exactly is meant by ownership? As is always the narrative, BlackRock clients own the shares, and the company simply manages these funds. As this article from CNBC demonstrates, its influence could seem more threatening than it actually is.

The value of the company is nowhere near its assets:

“That’s because BlackRock makes money by collecting fees from its investors, not by reaping profits from the companies it invests in. In short, BlackRock doesn’t own a portion of many US corporations. The people who own shares in BlackRock funds do.”

But perhaps this just demonstrates the problem, that BlackRock are doing all this by proxy, with our money. And it should also be pointed out that CNBC is a division of NBC Universal News Group. This is a subsidiary of NBC Universal, which is owned by Comcast, which BlackRock and Vanguard own majority shares in.

This is just one article, but would CNBC take a full stance against its biggest shareholders? Probably not. BlackRock and the Big Three might not run the world as a cabal of evil.

But it’s more that this is creating a problem of economic disparity. It will create a situation where one single company owns the investments for the entire world, and there’s nothing that we could do about it. Things will get more stagnant, and economically worse for the poor, while BlackRock and its investors profit.

Entire nations could also be at the mercy of corporations. BlackRock can influence global markets, and governments, and the more its power increases, there is a chance that one day, BlackRock could oversee a majority of the global economy, wielding more power than any government or company in history, all the while being able to deny that they have control.

Companies such as BlackRock have oversight over so much of the economy which is still in the dark. Even economists and politicians don’t know exactly BlackRock’s influence. Perhaps even Fink himself is unsure.

BlackRock may not own things, or control things directly. But they have fingers in many, many pies, more than any company in history.

Next time you’re researching a company, trace the shareholders back and see if BlackRock is in there somewhere. Chances are they will be.