The World Bank and IMF International Monetary Fund (IMF) are American institutions that were set up after the Second World War. These two organisations are separate, but operate in a similar world and often intertwine.

The core function of both organisations is to offer loans to countries in trouble and work to maintain economic stability in unstable regions. They make decisions on how the economy operates, which countries receive more money, and who is in charge of these economies.

The IMF, as per its website, states that it “works to achieve sustainable growth and prosperity for all of its 191 member countries. The World Bank Group states that it is “a unique global partnership fighting poverty worldwide through sustainable solutions.”

Although the World Bank and the IMF are separate organisations, they are often spoken about as one entity, as they were created at the same time, and often work collaboratively. Superficially, they seem like the same thing, and even economic experts sometimes have trouble distinguishing them. John Maynard Keynes admitted himself that he was confused when it came to distinguishing the two, stating that he “thought the Fund should be called a bank, and the Bank should be called a fund.”

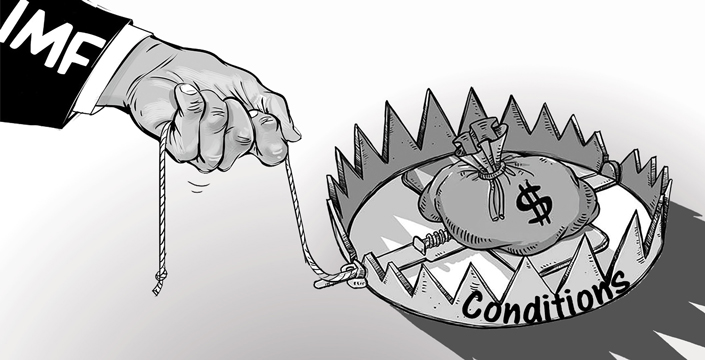

Although both organisations have a charitable tone, critics dispute the intention. Both organisations receive criticism for operating as tools for neocolonialism and maintaining global apartheid, as they allow the US to impose economic obligations on smaller countries – thus maintaining dollar dominance.

The World Bank

The World Bank brands itself as a “development institution” which serves to “promote social progress in developing countries by helping to raise productivity so that their people may live a better and fuller life”.

The World Bank (officially called the World Bank Group) is actually an umbrella for five international organisations, all operating in similar industries.

These organisations are:

- International Bank for Reconstruction and Development (IBRD), established in 1944 (main lending arm)

- International Development Association (IDA), established in 1960 (concessional loans and grants)

- International Finance Corporation (IFC), 1956 (investment, advisory, and asset-management services)

- International Centre for Settlement of Investment Disputes (ICSID), 1965 (legal dispute resolution and conciliation between international investors and States)

- Multilateral Investment Guarantee Agency (MIGA), 1988 (political risk insurance and credit enhancement guarantees)

As of 2025, the World Bank is owed $437 billion, with India, Indonesia and Pakistan making up $81.5 billion of this total amount.

The IMF

The International Monetary Fund (IMF) brands itself as a “co-operative institution that seeks to maintain an orderly system of payments and receipts between nations”.

Its purpose is to maintain economic stability in the world and “administer a pool of money from which members can borrow when they are in trouble”. You can find all the records of how much is owed to the IMF on the IMF’s official website.

As of 2025, the IMF is owed $144.9bn, with Argentina, Egypt, Ukraine and Pakistan making up the largest portion of this.

How different are the World Bank and IMF?

The World Bank and IMF are closely related, and are even across the road from each other. The two organisations frequently collaborate on projects, in accordance with a 1989 agreement.

A statement from the World Bank outlines the difference between the World Bank and the IMF:

The World Bank and the International Monetary Fund (IMF) were founded at the same time, and their headquarters are across the street from one another in Washington, DC. But while the work of the Bank and the Fund are complementary, their individual roles are quite different.

The World Bank is a lending institution whose aim is to promote long-term economic growth that reduces poverty in developing countries. The IMF acts as a monitor of the world’s currencies by helping to maintain an orderly system of payments between all countries, and lends money to those of its members who face serious balance of payments deficits.

The main ways the two organisations work together are through meetings and collaborations on certain projects. Although the two organisations are separate, they have a unified agenda and often go hand-in-hand.

Collaborative meetings

The World Bank and IMF hold annual meetings of the Boards of Governors of the IMF and the World Bank, where they discuss affairs in both remits. The Development Committee is also attended by members of both organisations.

In private, the managing director of the IMF and the President of the World Bank meet regularly to consult on major issues, and will issue joint statements, articles, and conduct country visits together. Other internal meetings between the two organisations are common.

Direct collaborations

Aside from meetings, the IMF and the World Bank collaborate on policy, reforms, and general advice. The World Bank will base a large amount of its assessments and policies on data from the IMF, and conversely, the IMF will heed advice on structural and sectoral reforms.

Other initiatives and programs the two organisations collaborate on include:

- The Heavily Indebted Poor Countries (HIPC) Initiative

- The Financial Sector Assessment Program (FSAP)

- The Multilateral Debt Relief Initiative (MDRI)

- The Debt Sustainability Framework (DSF)

Joining the 2030 Global Development Agenda in 2015, both organisations work together to support member countries in reaching the Sustainable Development Goals (SDGs), which aim to promote five elements of “people, planet, peace, prosperity, and partnership”.

The origins of the World Bank and IMF

As much as the two organisations seem like deeply institutional monetary organisations carved from the stone of Mount Rushmore, they are far younger than they seem, much like other behemoths such as BlackRock. Both the World Bank and the IMF are less than 100 years old and were created after the Second World War, forged alongside the Bretton Woods System, yet have already become a bedrock of the global economy.

The Bretton Woods System

Before the Second World War, many major world economies relied on the gold standard to stabilise their currencies. But after the widespread physical and economic destruction of the war, most economies were in ruins and were scrambling to rebuild.

As with any race to rebuild, a growing paranoia and suspicion began to arise. There was a growing worry that countries becoming isolationist in trying to fix their economies would make things even worse, implementing what are known as ‘beggar thy neighbour’ policies – essentially, making things worse for others in order to get ahead.

The US stepped up in 1944 after decades of handing out debts to Europe and proposed a new system to restore economic stability. This system would mean all participating currencies would be fixed to the price of the US dollar, and the US dollar would be fixed to the price of gold. Essentially, implementing a gold standard by proxy.

This system came to be known as the Bretton Woods system, and 44 allied nations agreed to be part of it.

- Australia

- Belgium

- Bolivia

- Brazil

- Canada

- Chile

- China

- Colombia

- Costa Rica

- Cuba

- Czechoslovakia

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Ethiopia

- France

- Greece

- Guatemala

- Haiti

- Honduras

- Iceland

- India

- Iran

- Iraq

- Lebanon

- Luxembourg

- Mexico

- Netherlands

- New Zealand

- Nicaragua

- Norway

- Panama

- Paraguay

- Peru

- Philippines

- Poland

- South Africa

- Syria

- Turkey

- United Kingdom

- United States

- Uruguay

- Yugoslavia

It is important to remember that the US also controlled two-thirds of the world’s gold at the time, so the rest of the world had little choice, lest they risk branching out on their own and attempting to fix things solo.

The World Bank and IMF were created to help monitor and maintain this system. Naturally, Soviet representatives backed out, citing the institutions to be simply “branches of Wall Street”.

The end of the Bretton Woods system

In a macro view of history, the Bretton Woods system was a flash in the pan and lasted less than 30 years. On August 15th, 1971, President Nixon brought a swift end to the agreement due to fears that pressure on the US gold reserves was undermining the dollar. In short, foreign countries such as France were buying more gold than the US could keep a handle of, so they pulled the plug on the entire system.

This whiplash change is referred to as Nixon Shock. The end of the system meant that the US dollar became free-floating; it was attached to nothing and relied purely on the trust in the currency, becoming ‘fiat’ currency. As a result, the 44 allied nations were also cut from this deal, and also became free-floating overnight. Some remained free-floating, but weaker currencies either suffered economic turmoil or had to form a brand new deal with the US.

By the end of the 1970s, the dominance of America’s currency had been well established, and it set in motion the true roots of dollar dominance.

Enter the Arbiters of dollar dominance

Today, 65 currencies are directly pegged to the US dollar, and 11 countries use the US dollar as their official currency.

This widespread use of the dollar gives the US unmatched control over the world economy, and the World Bank and IMF are the organisations used to maintain dollar dominance. They maintain the necessity of dollars via loans and ensure that the money is always flowing back into the US.

There is literally nowhere to hide from the dollar, and every country must participate in it.

Shi Yu, China Daily | https://www.chinadailyhk.com/article/a/290315

Rigged voting

The World Bank ‘represents’ 188 countries with its loans and programs. All countries get a vote in major decisions in these countries, such as who is in charge of the banks, as well as the senior management.

There are separate organisations within the World Bank, and each country is allocated different voting powers and decisions within each arm of the organisation – the World Bank explains its specific process.

To recap, the organisations are:

- International Bank for Reconstruction and Development (IBRD)

- International Finance Corporation (IFC)

- International Development Association (IDA)

- Multilateral Investment Guarantee Agency (MIGA)

However, not all votes are created equal. The crucial aspect here is the weighting of the United States’ voting power in each, notably, the majority in all:

Japan, China, Germany, the UK, and France clean up the remaining majority votes.

So while the World Bank represents these countries and allows them voting power in decisions on their own economies, the voting power they are given is negligible. Votes are based on contributions, so the more money you put into the World Bank, the more voting power you get. Naturally, the decisions made, such as choosing leadership and which countries to support and how much, will always be skewed towards American interests and those that pay the most.

This is how the US can (and does) control the world economy to its advantage.

“By gifts one makes slaves”

David Graeber, in Debt: The First 5,000 Years, refers to a section of Danish explorer Peter Freuchen’s Book of the Eskimo, where he offends a hunter by thanking him for a gift:

Freuchen tells how one day, after coming home hungry from an unsuccessful walrus-hunting expedition, he found one of the successful hunters dropping off several hundred pounds of meat. He thanked him profusely. The man objected indignantly:

“Up in our country we are human!” said the hunter.

“And since we are human we help each other. We don’t like to hear anybody say thanks for that. What I get today you may get tomorrow. Up here we say that by gifts one makes slaves and by whips one makes dogs.”

It is difficult to crack through the positive veneer of the organisations that lend billions to countries in need, and arguably, both organisations have likely contributed some good through their debt giving.

But despite what the World Bank and IMF claim, global apartheid is unchanged, and income inequality is rising. Both organisations continue to lend billions, and poorer countries continue to rack up debt. Jeffrey Sachs cited that for the IMF, the “usual prescription is ‘budgetary belt tightening to countries who are much too poor to own belts'”

IMF surcharges are estimated to increase borrowing costs on average by 64.1%, punishing the economies already in economic turmoil. Furthermore, IMF loans cannot be rescheduled or renegotiated. As always, the poorest in each of these poorer nations will be the ones really paying for these debts.