Chartalism – the new economic theory that everyone is talking about. To summarise, chartalism is the theory that the value of money is derived purely from the power of the state, and not from any intrinsic value. The question being asked here is: is money a true store of value, or just a token handed to us by governments like some big video game?

Chartalism has been built on by those now supporting Modern Monetary Theory (MMT), which is a full economic framework designed on these principles. Whether this theory is true or not, chartalism is crucial to understand, as it could explain the activity of many central banks, indicate why inflation is so high, and make you reconsider what money is in your mind.

Chartalism in a nutshell

Post Bretton Woods and post-Nixon Shock, all major currencies have become fiat currencies, which means they are not fixed to the price of gold. They are fixed only to the value of themselves. This might seem like a normal setup, but it is relatively new. This has not been seen in the modern world before, and essentially, central banks have been in uncharted waters since 1971. Chartalism is born from this and has created new ideas about what money really is.

Here are some of the fundamental principles of chartalism.

1. The value of money comes from authority

A key part of chartalism states that money only has value because the government demands it via taxes. In effect, the state upholds the value of the currency by imposing taxes, fines and other obligations on the population.

2. Taxes enforce the medium of exchange

Taxes must be paid for in currency, which is assigned by the government. If you are a US citizen, you have to pay your taxes in dollars. You have no choice. This creates a system where you are required to use the currency of the state, so citizens are willing to work and accept payment in this particular currency.

3. The government has unlimited money

Chartalism proposes that a government has unlimited money and literally cannot ever ‘run out’. They do not need to collect money like citizens, only spend and collect via taxes, regardless of their current balance sheet. As long as inflation and taxes are balanced, a government can spend money as it likes.

The old adage of a beginner asking why they can’t print more money has come full circle.

4. Money is a tool of policy, not financing

Perhaps the strongest and final point is that money is not about funds. Money is simply a tool used by governments to enforce behaviours. Issuing bonds and collecting taxes are to support the system.

With the population working to pay off their debts and taxes, with a currency that is unlimited, it seems that control is the ideal outcome for such a setup.

introducing Modern Monetary Theory (MMT)

The theory of chartalism has supported an entire framework of a new economic model, which is known as Modern Monetary Theory (MMT). MMT has unlocked the idea that governments can sustain higher spending levels than traditionally thought, as long as inflation is kept within reason.

Under MMT, taxes are not primarily a way for governments to raise funds. Instead, their purpose is to:

- Create demand for the government’s currency (since people need it to pay more taxes)

- Remove excess money from circulation to control inflation

- Help redistribute wealth and influence behaviour (e.g., carbon taxes)

MMT reframes the government deficit in a way that means it is not necessarily bad, or signifying that the government is ‘running out of money’, but rather is how the system is weighted.

A government deficit (spending more than it taxes) simply means that the private sector now has more net financial assets. Increasing taxes and collection will lower the assets in the private sector.

MMT suggests the government’s debt is just the savings of the private sector.

The Fed & skyrocketing debt

Chartalism and MMT could explain why the Fed might be printing money without a care in the world while US debt skyrockets.

The Fed have been printing money at obscene rates to the point where now people are asking whether money is even real or not. What is slightly more alarming is the rate at which this debt is growing.

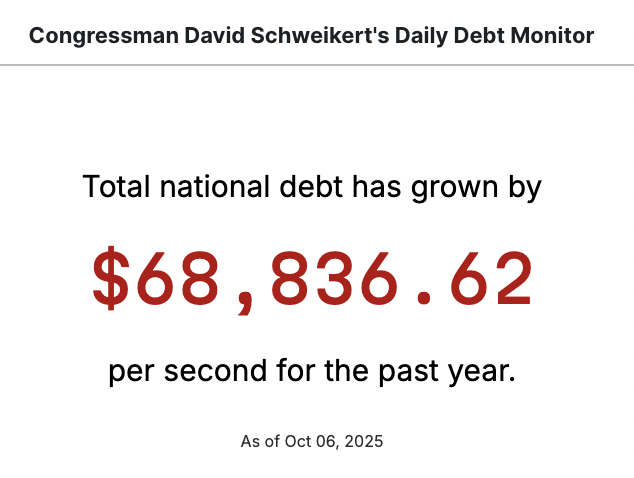

The US government owes $37.9 trillion as of October 2025. Congressman David Schweikert’s Daily Debt Monitor shows that total national debt in the US in 2025 has been growing at a rate of $68,836 per second for the past year, which amounts to almost $6 billion per day.

Obviously, this isn’t just debt with no returns. The Fed might have roughly $200 billion in securities coming due in a month, and this money is often reinvested into more securities. Essentially, the whole thing is a balancing act.

Of the debt, 71% of the US Treasury market is held domestically, which, according to Al Jazeera from May 2025, is roughly $27.2 trillion. From this, around 42% is held by US private investors and entities, mostly in the form of savings bonds, mutual funds and pension funds. Roughly 20% is held by intra-governmental US agencies and trusts, and the final 13% is held by the Fed itself. According to the official Fed balance sheet, the Fed holds roughly $4.19 trillion in treasury bonds.

The Fed buys its own Treasury bonds to initiate quantitative easing (QE) to boost the economy. In simple terms, if the Fed buys more Treasury bonds, there is more money ‘injected’ into the economy, which means spending will increase.

“If the government can print money out of thin air, why do they charge taxes?”

Nayib Bukele, the president of El Salvador (and the world’s ‘coolest dictator’), has been openly critical of the US government’s foreign policy, and particularly dollar dominance. It explains El Salvador’s attempt a few years ago to make Bitcoin the currency of the country, instead of the US dollar.

A clip from Nayib Bukele is a great example of chartalist ideals:

Government is financed by treasury bonds. Paper. And who buys the treasury bonds? Mostly the Fed. And how does the Fed buy them? By printing money. But what backing does the Fed have for that money being printed? The treasury bonds themselves!

So basically, you finance the government by printing money out of thin air. Well so if the government can print unlimited amounts of money out of thin air, why do they collect taxes?

The answer is simple but it’s very shocking. The real problem is that you pay high taxes only to uphold the illusion that you are funding the government which you are not.

So why does chartalism concern me?

So why is it important to care about this? This seems like the concerns of central banks, and nothing to do with working people.

The main reason is to reframe the idea of money having any actual value. All working people in 2025 should consider that money is simply a token of the state, instead of being an asset. This is how the Fed and all other central banks treat it, so it is important that people know the game that they are part of. As governments sell off their assets and start to embrace MMT, people should start to forget their money and be concerned with acquiring wealth. As inflation rises from the activity of central banks, money will start to become a lot more worthless than it already is.